Preface

Lebanon has been suffering from a chronic shortage in power supply for decades, however private diesel generators and recently installed individual solar power grids are diminishing blackouts across the country. The civil war resulted in a massive destruction of Lebanon’s infrastructure, and considerable investment in the energy sector, in the form of foreign aid, loans, and technical support, have been inappropriately handled and subsequently wasted.

While the world is now moving to an era of renewable and smart energy, Lebanon’s energy model still relies on heavy fuel oil plants and diesel generators. The country imports 97% of its energy, most of which is fossil fuel. The electricity sector is costing the treasury about $2 billion annually due to several reasons: freezing of Electricity tariffs since 1994, high operational costs, low efficiency old plants, high technical and non-technical losses, non-collected bills, the Syrian refugee added consumption of electricity coupled with a lack of transparency, credibility, and accountability.

The planned reforms presented in the “Policy Paper for Electricity Sector” in 2010, and updated in 2019, claim to provide stability and profitability to the sector if implemented. Both versions of the policy briefs, however, contained no reference to the nascent petroleum sector and its potential influence on several of the components of the electricity plan (number of Floating Storage and Regasification Units-FSRUs, proposed and potential energy mix suitable for Lebanon vis-à-vis future discoveries, etc). It is note-worthy that both the original as well as the updated versions of the paper were issued during two critical junctures of our budding petroleum sector: 2010 was the year when the first legislative cornerstone of Lebanon’s petroleum sector was ratified in the form of Law 132/2010 “Offshore Petroleum Regulation Law”, and 2019 marks the year when preparations for the drilling of the first well in Lebanese Offshore Bloc 4 were well underway.

Here we will be presenting the current situation of the energy sector in Lebanon, its main challenges, and the potential benefits that green energy can offer.

Gas gas everywhere but not a molecule to find

A complete guide to the energy situation in Lebanon by expert Diana Kaissy now that Block 9 also proved disappointing: NO GAS FOUND.

While the early steps (2010-2013) exhibited a fast-paced approach towards launching the oil and gas sector, this enthusiasm did not translate into much-needed action for launching this first licensing round. For unknown reasons, a political deadlock translated into refraining from ratification of the two decrees for 4 years. In 2013, the price of oil reached the $100 per barrel mark, the high profit margins meant that international oil companies at that time would have had a larger appetite for investments in exploration (hence the impressive number of companies interested in prequalifying for Lebanon’s licensing rounds).

The unexplained delays of ratifying the two decrees to complete the legal requirements to issue the first licensing round conveyed a negative message to international investors: thus political deadlocks affected any progress in the nascent petroleum sector in Lebanon.

Subsequently, when the Lebanese government finally issued the two decrees, four years later (2017), the world, especially that of the extractive sector, was in a different place. The price of oil and gas had drastically plummeted with the barrel of oil reaching $35 per barrel. The appetite of the investors had shrunk considerably, with little to almost no profits made by international oil companies to cushion the risk of new exploration. That window of opportunity was lost.

Not surprisingly, the first licensing round of 2017 resulted in a single consortium bidding for two out of the five offshore blocks offered. In January 29, 2018, a consortium composed of Total S.A. as Right-holder Operator and Eni International BV and JSC Novatek as Right-holders Non-operators, was awarded Exploration and Production Agreements (EPAs) for blocks 4 and 9.

In early 2020, the consortium drilled its first exploratory well in Block 4. After almost 60 days of drilling, the results were disappointing, but unsurprising to the experts who had been consistently calling for management of expectations. While traces of hydrocarbons were found, indicating the existence of a hydrocarbon system, no reservoir was found. The reaction from the established political parties was equally disappointing. Instead of approaching the issue with the technical objectivity that is required and advised as best practice to ensure the continued and sustainable development of Lebanon’s petroleum sector, their reactions swung like a pendulum ranging from disbelief and therefore accusations addressed to the consortium of hiding the gas finds, to accusations that some political parties that have been claiming presidency over the petroleum portfolio were lying to the public about Lebanon becoming an oil producing country.

In parallel to the exploration activity in Bloc 4, another track was slowly but steadily moving through US mediation. After several years of ineffective US led shuttle diplomacy to resolve the southern maritime border issue between Lebanon and Israel, agreement was reached to adopt Line 23 with its coordinates to divide the offshore area between Lebanon and Israel. The agreement freed all protracted areas from Lebanon’s southern blocs (8,9,10). Total, being the operator in the consortium, was asked to agree with Israel on a framework agreement that laid the grounds for future revenue distribution in case drilling in Bloc 9 yielded a discovery of a gas field that extended beyond the recently agreed on maritime borders.

Greenpeace classified the city of Jounieh, which is near Zouk’s thermal power plant as the 5th most air polluted town in the Arab world. What is the outlook?

The consortium, with QatarEnergy replacing Novatek with minority 30% stake in two blocks of Lebanon's exclusive economic zone (January 2023), resumed its attempt to drill another exploratory well in Block 9. Drilling started by the end of August 2023. The 57 days of drilling resulted in yet again another disappointment (drilling completed in October 2023). However, the difference this time was that a reservoir was found, only it contained water instead of gas. Equally unfortunate was the similar reaction that political parties exhibited upon the news of yet another no gas find.

Currently the Lebanese Petroleum Administration is looking into two new bids received by the same consortium (during the 2nd licensing round that was launched by Lebanon in 2020 and closed in early October 2023) for blocks 8 and 10. Preliminary information indicates that the bids are not in Lebanon’s favor.

Finite vs Renewable

The first lamp in Lebanon was lit during the Ottoman Empire in 1885. Starting in 1906, “Société Anonyme Ottomane des Tramways et de l’Électricité de Beyrouth” opted to power the electric tramcars via combustion engines, while at the same time expanding the initial development project to include the provisioning of electricity for other uses. In 1911, Belgian investment operated the energy sector in Lebanon, before it became a French company in 1923. By 1952, about 30 electricity generation companies were operating in Lebanon and covered generation, transmission, and distribution.

But it was only on July 10th 1964 that the Lebanese Government founded its Electricite Du Liban-EDL, a public establishment with an industrial and commercial vocation. Founded by Decree No. 16878/1964, it is responsible for the generation, transmission, and distribution of electrical energy in Lebanon. The establishment controls over 90% of the country’s electricity sector (including the Kadisha concession in North Lebanon which is owned by EDL). Other participants in the sector include hydroelectric power plants owned by the Litani River Authority, concessions for hydroelectric power plants such as Nahr Ibrahim and Al Bared, in addition to concessions for distribution in Zahle, Jbeil, and Bhamdoun.

In 2016, EDL produced more than 13 Million Gwh through 7 major thermal power plants owned directly or indirectly by the establishment and located in different areas of Lebanon. Currently, the number of employees at EDL is around 1,720 (according to EDL’s official organizational structure, this figure bshould be 5020) serving more than 1,400,000 subscribers of low, medium, and high voltage.

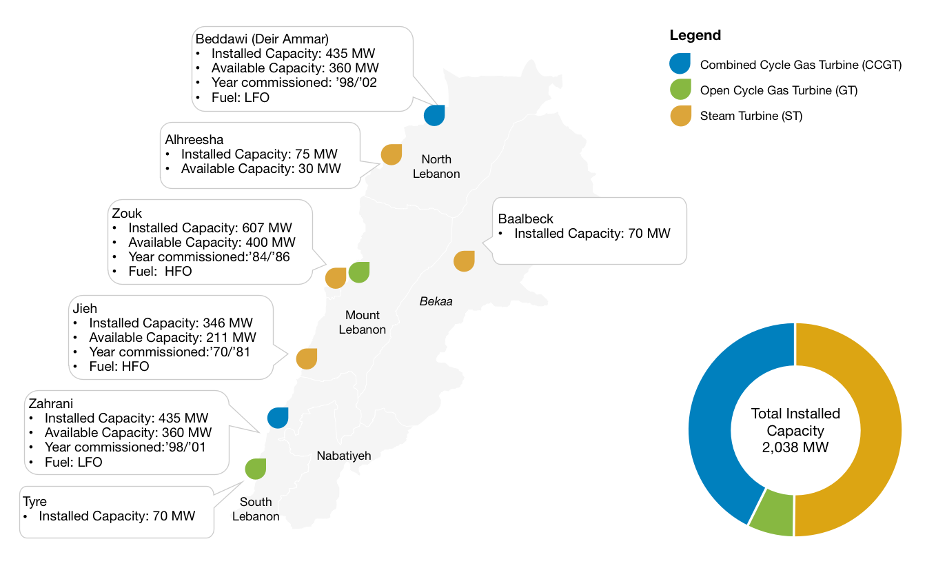

Lebanon has 7 thermal power plants, the largest of which is Zouk, whose units were put in service between 1984 & 1987, Jieh’s units started operating between 1970 & 1981, Sour and Baalback were put in service in 1996, Zahrani between 1998 & 2001, whereas Deir Ammar initiated electricity production between 1998 & 2002.

Thermal Power Plants in Lebanon. Source: carboun.com

Thermal Power Plants in Lebanon. Source: carboun.com

Thermal Power Plants in Lebanon. Source: carboun.com

In response to the growing electricity deficit, the use of privately-owned diesel generators today is widespread, though, the current deterioration of EDL supply and fuel shortages have put the generators under pressure too and made them unable to fully cover the blackout periods.

The informal, generator businesses started to establish themselves after the outset of the civil war in 1990 and spread further after 2006, when Beirut also started to have increasing electricity outages. In 2017, according to UNDP, 66% of Lebanon’s households relied in some way on diesel generators. Typically, the arrangements entail that each household pays for a subscription to a generator owned by a local “entrepreneur” who then delivers low voltage power when the national grid is off. Paying two electricity bills, one for EDL and one for a local generator owner, is today a normalized practice for most residents. High reliance on private diesel powered generators is not only costly but is also leading to air pollution since burning such types of fuel generates particulate matter as well as toxic gasses such as NOx and CO2. The emissions of such generators increase air pollution problems to the point at which Greenpeace classified the city of Jounieh, which is near Zouk’s thermal power plant as the 5th most air polluted town in the Arab world.

These pollutants lead to adverse physical and mental health problems such as anxiety, depression, attention problems, premature death, asthma, cardio-vascular disease, lung cancer and other pulmonary diseases.

Today, renewable energy projects for Lebanon exist only on paper. The lag is due in large part to the ongoing financial crisis that hit the country in 2019. For international firms, Lebanon continues to be a high risk investment.

Successive Ministers of Energy and Water have promised the Lebanese people uninterrupted power supply, but none of their plans have come to fruition, and the blame game is always on the table. The “Policy Paper for the Electricity Sector” of 2010 included 10 strategic initiatives covering the sector’s infrastructure, supply/demand, and ensuing legal aspects. The paper claimed that the policy would result in a solid power sector with more than 4,000 MW generation capacity in 2014 and 5,000 MW after 2015, reliable transmission and distribution networks, and efficient delivery of electricity to cope with the overall socio-economic development of Lebanon. The full implementation of the strategic initiatives in this policy was also claimed to reduce the total losses from $4.4 Billion in 2010 to zero in 2014 where 24 hours of service will be provided, and the possibility of profit making as of 2015; compared to an annual loss of $9.5 Billion by 2015 if no action was taken. Unfortunately, the situation throughout the last decade covering the implementation did not go according to plan. In 2018, the cumulative debt of EDL reached $30 Billion.

In March 2019, an updated version of the policy was issued and targeted three proposed solutions: Decrease losses along with collection improvement, increase generation capacity by substituting Diesel Oil and Heavy Fuel Oil with Liquid Natural Gas, and increase the tariff (including collecting bills from refugee camps). Due to the economic crisis, the Lebanese Government sought World Bank support to cover the expenses. The funding was approved on three conditions: auditing EDL, activate its newly announced regulatory authority, and recover provision costs through collection – conditions that won’t be obviously implemented in the near future. Engineer Kamal Hayek was assigned as the General Manager of EDL in 2002 for a 3 year term; he is still in this position. The long awaited board of directors was finally appointed in July 2020, but the Electricity Regulatory Authority (ERA) mandated under Law 462 in 2002 is still to be implemented. Even EDZ has been working illegally since 2018, and a new bid deadline to operate the sector ended on October 19 2023.

Other aspects of mismanagement within the sector include the exceptionally high salaries and political connections of EDL administrative staff. Another costly practice is that EDL, steered by the political elite, has been distributing free electricity to their constituents to increase their voter base. Further, tens of thousands of people get free electricity by illegally connecting to the grid, with many of those deriving protection from their party affiliation.

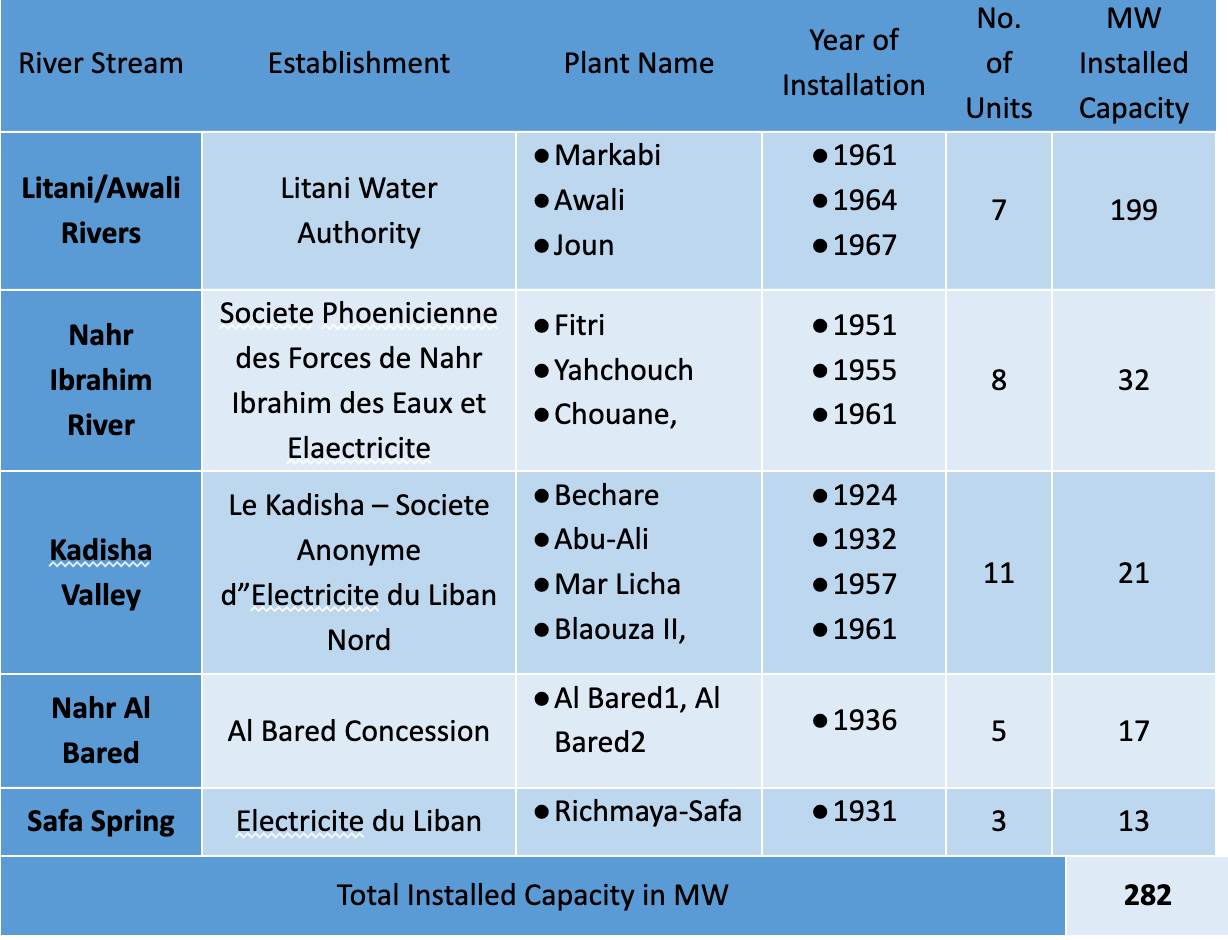

When it comes to sources of renewable energy, Lebanon has 17 major rivers, and the capacity of all 5 installed Lebanese hydropower plants totals 282MW. As most of the units have exceeded their expected technical lifetime, thereby currently producing only part of their nominal capacity or being completely out of service, the actual hydropower generation capacity is limited to nearly 190MW. Recent efforts such as those executed through The Innovation for Affordable and Renewable Energy (INARA) project have managed to successfully repair the 168-meter Kfar Niss Penstock which is connected to the Rechmaya hydropower plant. This first milestone will bring back around 7MW of electricity to 17 different communities in the Chouf and Aley districts.

Hydropower Plants in Lebanon. Source: CEDRO

Hydropower Plants in Lebanon. Source: CEDRO

Hydropower Plants in Lebanon. Source: CEDRO

Hydropower was the first form of renewable energy to be deployed in Lebanon. However, low contracted prices and lack of maintenance and/or refurbishment of hydropower plants have led to a continuous drop in the share of hydropower in the energy mix. The main potential of hydropower in Lebanon is derived from four main sources: rehabilitation of existing power plants; construction of new power plants; micro hydro run-of-river applications; and generation from non-river sources. The rehabilitation of existing power plants can help increase their annual generation by more than 1,000GWh. With the construction of new power plants, the available potential is estimated at around 368MW in the peak scheme and 263MW in the run-of-river scheme. The last source of hydropower potential derives from micro-hydro and non-river sources estimated to be around 5MW.

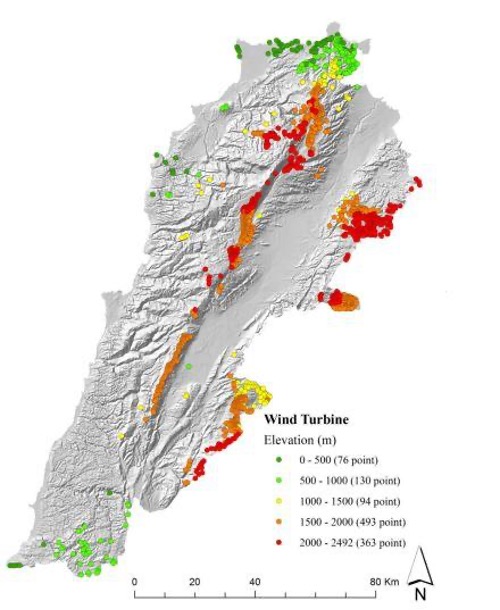

The mean wind capacity potential in Lebanon is 6,100 MW according to Wind Atlas, where 60% of windiest areas have an average wind speed of between 5-7m/s. Studies have revealed potential areas for wind farms across Lebanon using Conventional Wind Turbines (CWTs) and Ferris Wheel Wind Turbines (FWWTs). A study published by the “National Council for Scientific Research” (CNRS) marks 1,156 potential locations for wind turbine installment, of which 94% have wind speed between 7-9 m/s, and 6% receive 9-13m/s.

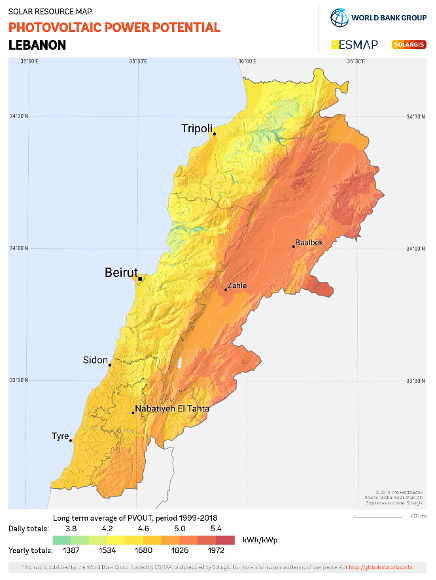

Lebanon has around 300 sunny days a year, with 8 to 9 hours of sunshine a day and insolation between 2 and 8kWh/m2/day. In addition to the solar irradiance levels, the relative lack of dust and sand and the moderate temperatures make Lebanon favorable for solar PV farms and ensure maximum efficiency.

In February 2017, the Ministry of Energy and Water handed out three licenses to “Sustainable Akkar”, “Lebanon Wind Power”, and “Hawa Akkar” to generate 226MW from wind energy over a 20 year period. The council of ministers empowered the Minister of Energy and Water to execute a power purchase agreement (PPA) that was signed on February 1, 2018 with each of the project companies with a deadline of 18 months to reach financial close and an additional 18 months to reach commercial operations date (COD). The three above mentioned companies have no official websites, and their social media accounts do not reveal much. According to Global Data, a company that tracks and profiles over 170,000 power plants worldwide, Hawa Akkar is currently at the permitting stage. It will be developed in a single phase. Post completion of the construction, the project is expected to get commissioned in 2024. The project is expected to supply enough clean energy to power 100,000 households, and will have 85m high towers. A second round for bidders with a submission deadline of December 18, 2020 was intended to procure up to 520MW of wind farms, but no information regarding contracts or licensing is available.

In January 2017, the ministry announced the launching of a tendering process to award the construction of 12 solar PVs across the country. On May 12, 2022, the Council of Ministers issued 11 licenses to build 12 PV farms across Lebanon, procuring up to 180 MW.

Under the current contract, the 12 PV farms are required to build the power plants, operate them and sell the energy produced to EDL at prices varying per region (5.7 cents-6.25 cents).

The winning 11 companies were given 12 months to secure funding. So far it seems that a number of them will not be able to.

Today, all these projects still exist only on paper. The lag is due in large part to the ongoing financial crisis that hit Lebanon in 2019. For international firms, Lebanon continues to be a high risk investment.

All winning companies (wind and solar) face a common challenge: EDL monopolizes the purchase of electricity produced by these independent power producers. Electricity generated from solar PV projects will be sold at 5.7 US cents per kilowatt hour (USc/kWh) in the Bekaa and 6.27 USc/kWh in the other three regions. Electricity generated at the Akkar wind projects would be sold back to EDL at 9.60 USc/kWh. The huge caveat is that EDL is incapable of keeping itself afloat, let alone purchasing electricity from the above mentioned companies.

Wars resulted in a massive destruction of Lebanon’s infrastructure. Considerable investment in the energy sector, in the form of foreign aid, loans, and technical support, have been inappropriately handled and subsequently wasted.

To add to the complexity and definite elite capture of Lebanon’s potential power generation sources, Total Energies and Qatar Energies are currently in serious talks to buy at least 3 of the PPAs from the winning solar PV companies. Total Energies is also in contact with the companies awarded the PPAs for Akkar wind projects.

From a governance perspective, there are several issues at fault with the stars that should have been otherwise aligned for Lebanon to start depending on its renewable energy.

Transparency and inequity issues: A major point of contention is that the 11 licenses granted for the 12 PV farms did not pass through the Tender Board at the Central Inspection Bureau. This was a clear breach of the tendering protocols. Additionally, a law was ratified in 2014 (288/2014) to exceptionally allow the Council of Ministers to issue these production permits, instead of the Electricity Regulatory Authority (ERA), a body that is mandated into existence by Law 462/2012 but is yet to see life. As per this law, the ERA is responsible primarily for setting electricity tariffs, developing and launching tenders, and overseeing EDL’s unbundling as per the law 462. In its absence and conveniently, the ministry of energy and water is handling these issues.

When it comes to beneficial ownership, another issue arises around the ownership and controlling of shares of the 3 Akkar wind projects. Alaa Khawaja, the multinational businessman (Jordanian, Palestinian and Lebanese nationality holder) and former confidant of Saad Hariri, has the controlling stakes in all three license holders (Sustainable Akkar, Hawa Akkar, and Lebanon Wind Power). This is in direct contradiction to the anti-monopoly policy behind the issuing of the 3 licenses supposedly to 3 independent license holders.

Green washing and oligopoly: Over the past 2 decades, International Oil Companies have resorted to greenwashing their revenues from fossil fuel production by investing in renewable energy projects. This greenwashing continues to be hugely opposed by civil society. In Lebanon, the interest of big oil companies, such as Total Energies and Qatar Energies, in investing in clean energy production is, on the other hand, being welcomed by the Government of Lebanon and used as means to entice Big Oil foreign investments in Lebanon. Overall, this trajectory is filled with poor governance, dubious beneficial owners, and monopolization of energy production is not paving the road for a smooth and sustainable energy transition in Lebanon. The lack of transparency, unequitable financial opportunities, and oligopoly seem to be spreading their venom once again through a nascent but apparently very fragile renewable energy sector.

Trying to reform Lebanon’s energy sector may seem today to be an impossible mission to accomplish. There is not a single approach that could be singled out as the magical approach. All good hands –of the good fellas that remain in government, real civil society actors, foreign development agencies adhering to a concept of mutual accountability– need to be on deck. Transparency and accountability tools, governance indices, as well as best practices are being recurrently mentioned in the dozens, neigh tens of dozens of policy papers being produced in honor of our mounting energy crisis. As a committed energy governance specialist, I look at this venom-filled sector with the aim of unraveling it, as I would a matryoshka doll. And most importantly, I always use that one brilliantly phrased question to further unlock a maliciously carved plot to keep breaking down Lebanon: Cui bono?

Raseef22 is a not for profit entity. Our focus is on quality journalism. Every contribution to the NasRaseef membership goes directly towards journalism production. We stand independent, not accepting corporate sponsorships, sponsored content or political funding.

Support our mission to keep Raseef22 available to all readers by clicking here!

Interested in writing with us? Check our pitch process here!